Tax protected retirement savings accounts such as iras or 401 k plans can be directly rolled over into an annuity tax free as long as you follow the irs s requirements.

Can you roll a variable annuity into a 401k.

Non qualified just means it s not an ira 403b or 401k.

If you are moving non qualified money tax free then that is technically called a 1035 exchange.

Benefits of rolling over a 401 k or ira into an annuity.

If you own an annuity in a regular taxable account then there s no way to roll it over into a 401 k plan.

Once you retire no one is contributing to your 401 k any longer.

Non qualified variable annuities those established with after tax dollars are not eligible for a rollover to a traditional ira but you can move them into other types of non qualified accounts.

Rollover is another specific term used for moving ira money in a way that passes through your bank account first.

Only deferred annuities may be rolled into a new annuity.

Annuities funded with an ira or 401 k rollover are qualified plans enabling an insurance company to create an ira annuity into which you can deposit your retirement funds directly.

Annuities funded with an ira or 401 k rollover are considered qualified plans.

This is because 401 k plan contributions are tax deductible while annuity contributions outside of a retirement account are not tax deductible.

You can transfer your 401k to an annuity.

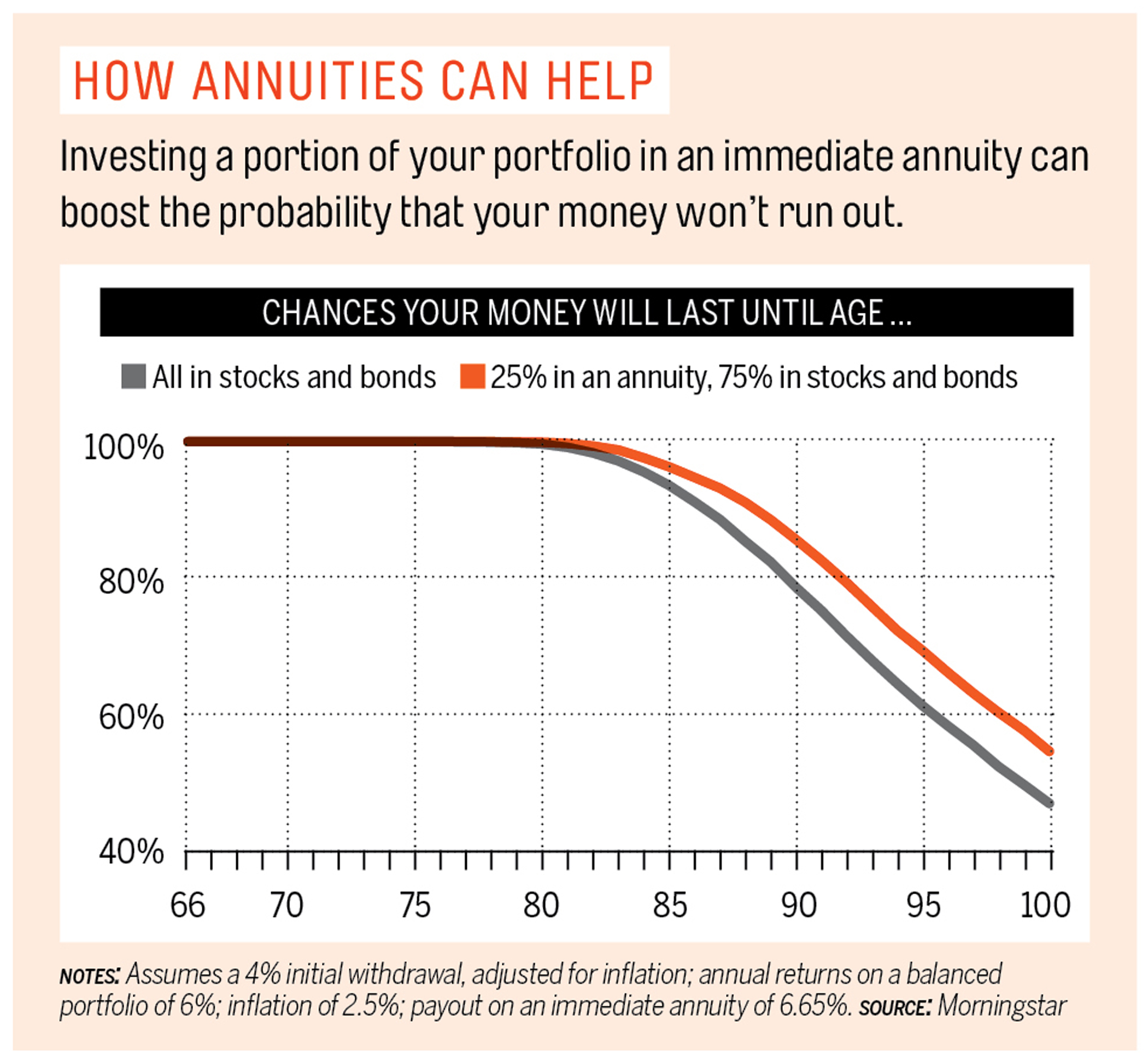

Then 401k annuities will offer another income stream that you can never outlive.

Some states place restrictions on your rollover.

You have someone looking out for your investment.

You can roll over your ira 401 k 403 b or lump sum pension payment into an annuity tax free.

Commingling qualified plan money with annuity assets that weren t initially treated as.

Using part of your 401 k or ira funds to buy an annuity can provide income in retirement.

There are 2 major benefits of rolling a 401 k or ira into a fixed annuity.

If your plan allows you can roll an annuity into your 401 k plan but only if you held your annuity in an individual retirement arrangement or another 401 k plan to begin with.

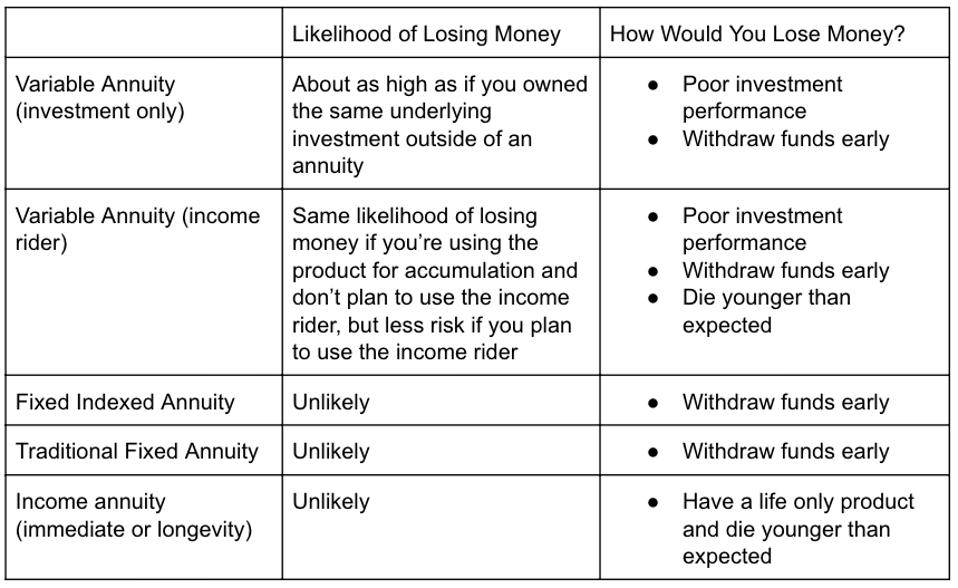

Key takeaways annuities can come with a host of fees and charges that reduce your funds.

Both are questions that involve a 401k rollover strategy.

Contact your insurer and request a 1035 exchange.

However a traditional 401 k is already tax sheltered and a delayed rollover could cost you in taxes.

If you are moving ira annuity money then the move would be called a transfer.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

/annuity_blocks-5bfc2f6146e0fb00511a6201.jpg)

/success-1093889_1920-73785c60ea884a3eb06341d5e7422b07.jpg)

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)

/shutterstock_290211914.annuity.zimmytws-550330c4cd704eecb80e957bff0960f3.jpg)

/GettyImages-1131086835-83fd238d51f44798943a4e69c1198537.jpg)